How to Trade Crypto at MEXC

Spot Trading on MEXC

What is Spot Trading

Spot trading is the method of buying and selling digital assets with other traders in real-time.

As the name suggests, transactions are settled immediately or "on the spot" as soon as the buying/selling order is filled.

Place Spot Trading Orders【PC】

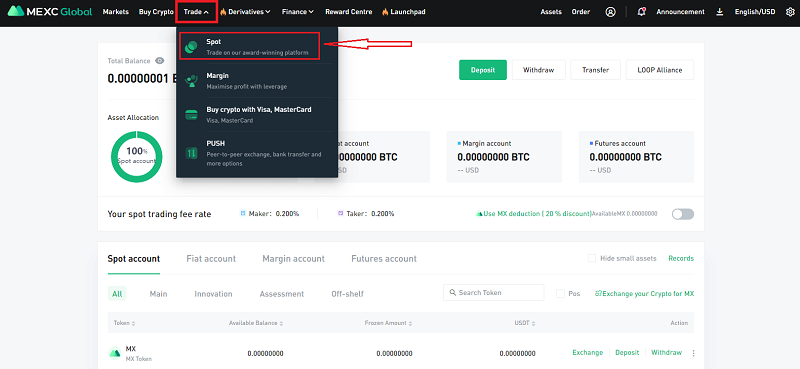

Step 1: Click "Trade", and select "Spot".Note: Please ensure that you have transferred the tokens from "Fiat account" or "Margin account" or "Future account" to "Spot account ", or you have deposited to your "Spot account" from a third-party.

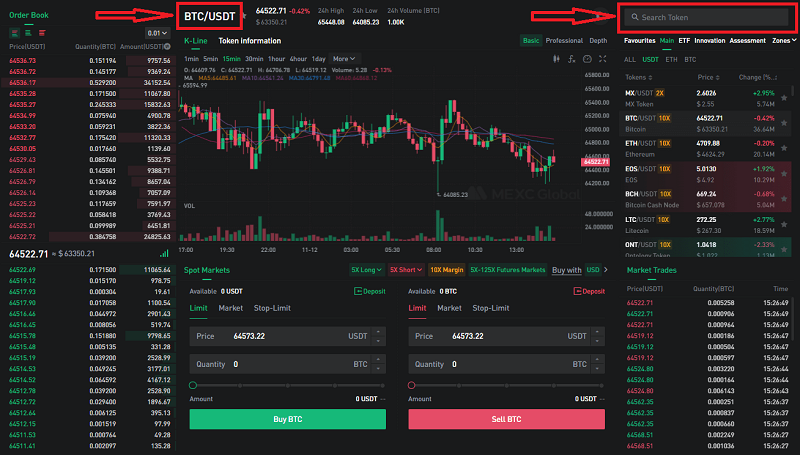

Step 2: Please select the trading pair that you want to trade directly, such as "BTC/USDT", or "search" it

Step 3:Select "Limit", "Market", or "Stop-Limit" based on your needs.

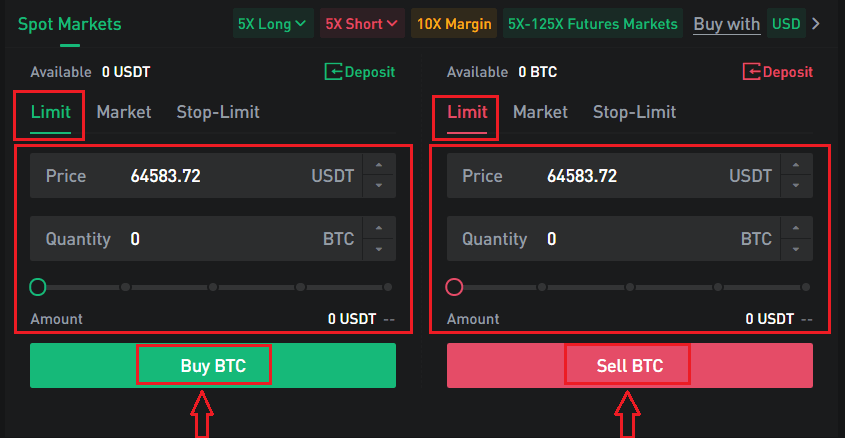

3.1 Limit Order

Please select "Limit", enter the "Price" and "Quantity", and click "Buy BTC" or "Sell BTC" to place the order

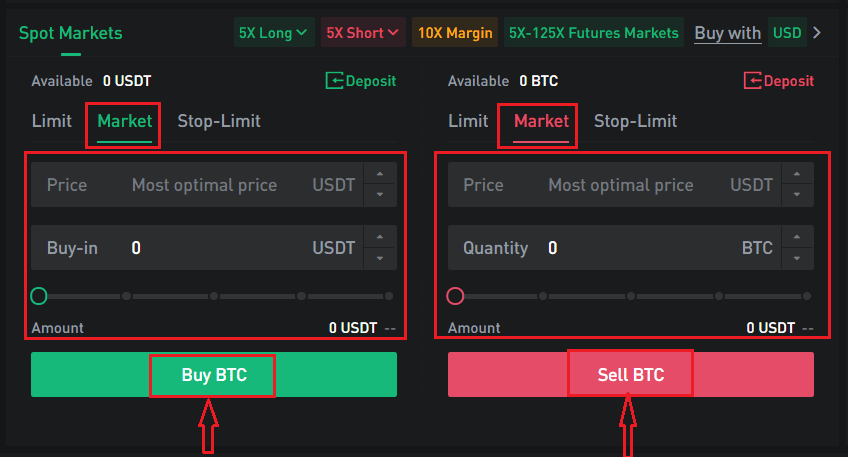

3.2 Market Order

Please select "Market", enter the "Price" or "Quantity", and click "Buy BTC" or "Sell BTC" to place the order.

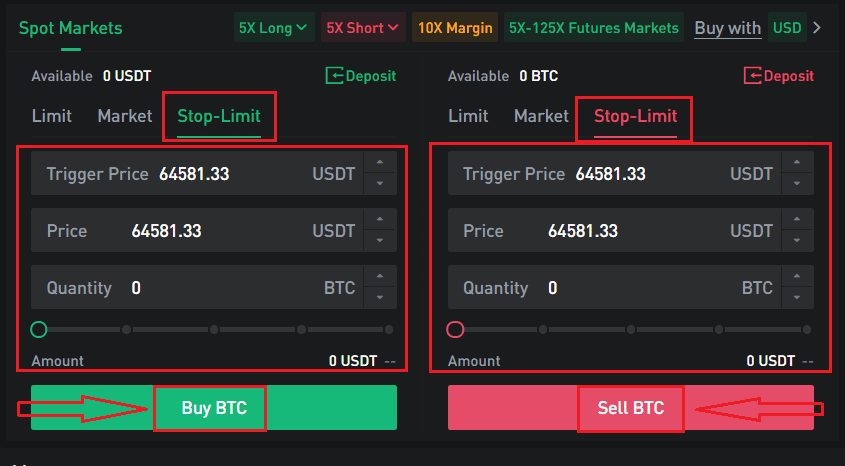

3.3 Stop-Limit

Please select "Stop-Limit", enter the "Trigger Price", "Price" and "Quantity", and click "Buy BTC" or "Sell BTC" to place the order.

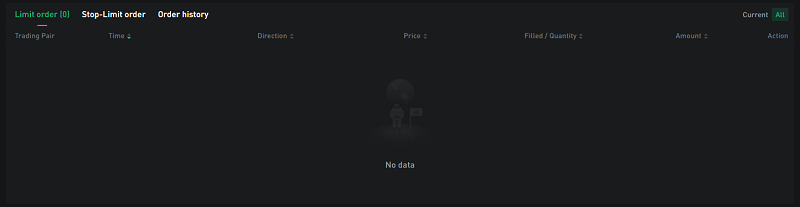

Step 4:Check the order state on "Limit Order" or "Stop-Limit" or "Order History" on the bottom of the page.

Place Spot Trading Orders【APP】

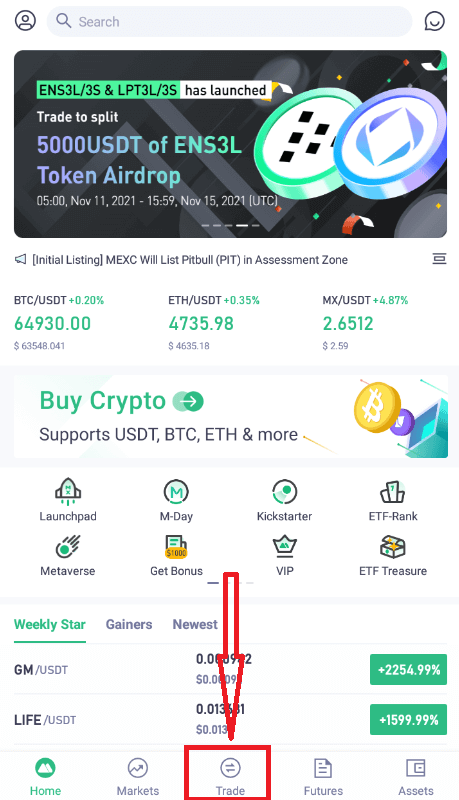

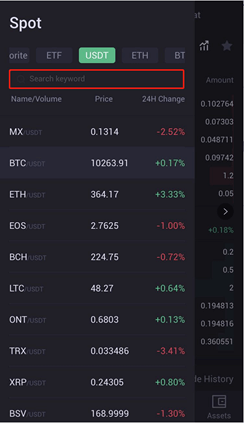

Heres how to start trading Spot on MEXCs App:1. On your MEXC App, tap [Trade] on the bottom to head to the spot trading interface.

Note: Please ensure that you have transferred your asset from Fiat, Margin or Futures account to your Spot account, or you have deposited the assets into your account.

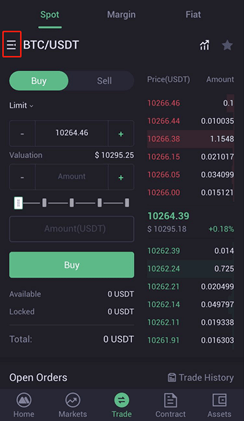

2. Choose the trading pair you want to trade. Here take BTC/USDT as an example.

|

|

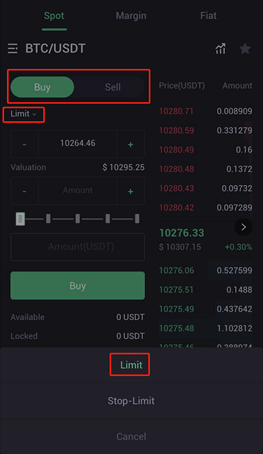

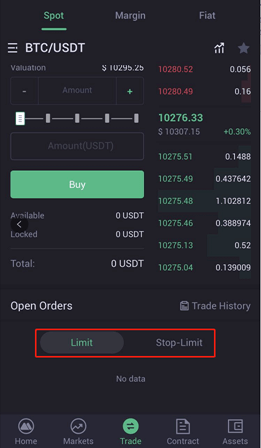

3. Select limit or stop-limit order

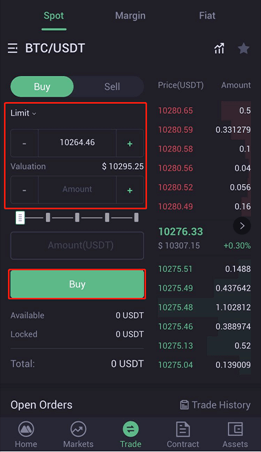

3.1 Limit Order

Select "Buy" or "Sell" and the order type of "Limit". Then, enter "Price" and "Quantity". Click "Buy" or "Sell" to place the order.

|

|

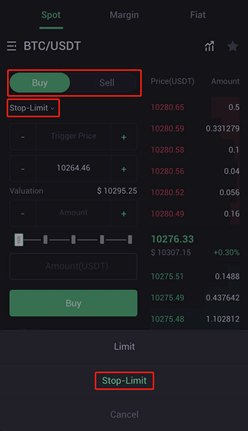

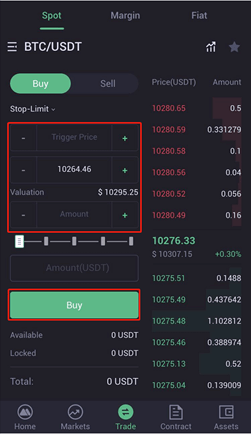

3.2 Stop-limit order

Select "Buy" or "Sell" and the order type of "Stop-Limit". Then, enter "Trigger Price", "Limit price" and "quantity". Click "Buy" or "Sell" to place the order.

|

|

Margin Trading on MEXC

What is Margin Trading

Margin Trading allows users to trade assets on borrowed funds in the crypto market. It amplifies trading results so that traders are able to reap larger profits on successful trades. Similarly, you are also at risk of losing your entire margin balance and all the open positions.

Only 5 steps to start trading Margin on MEXC:

- Activate your Margin account

- Transfer assets to your Margin wallet

- Borrowing assets

- Margin trading (Buy/Long or Sell Short)

- Repayment

How to use with Margin Trading

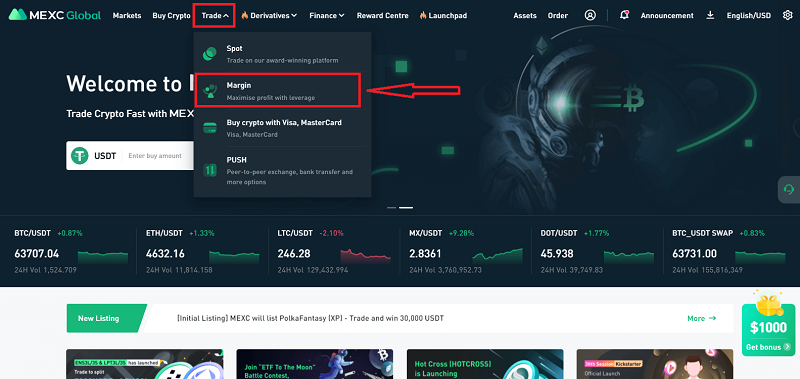

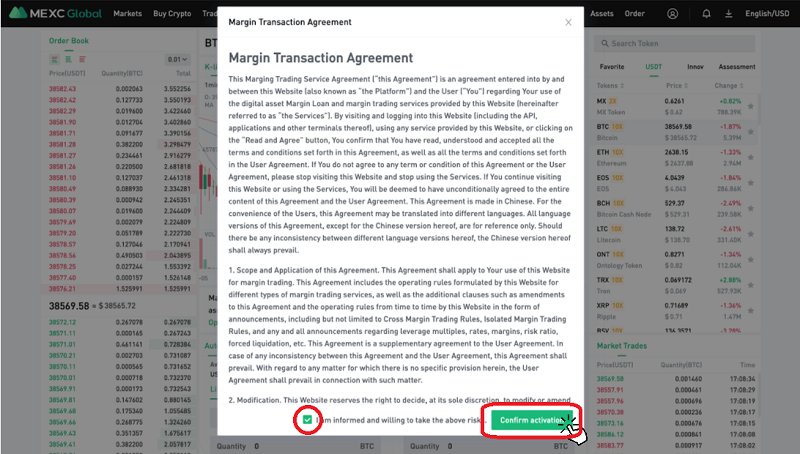

Step 1: Open a Margin Trading account

After logging in to your MEXC account, find [Trade] on the menu bar and click [Margin]

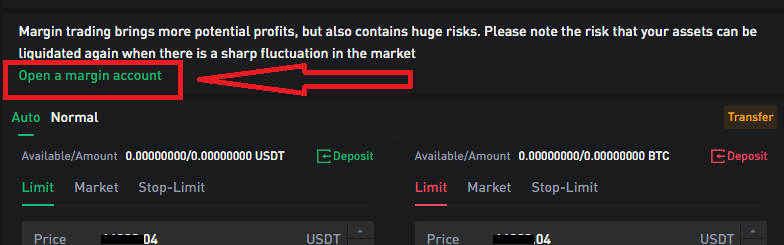

Once directed to the Margin market interface, click [Open a margin account] and read the Margin Transaction Agreeement. Click [Confirm activation] to proceed.

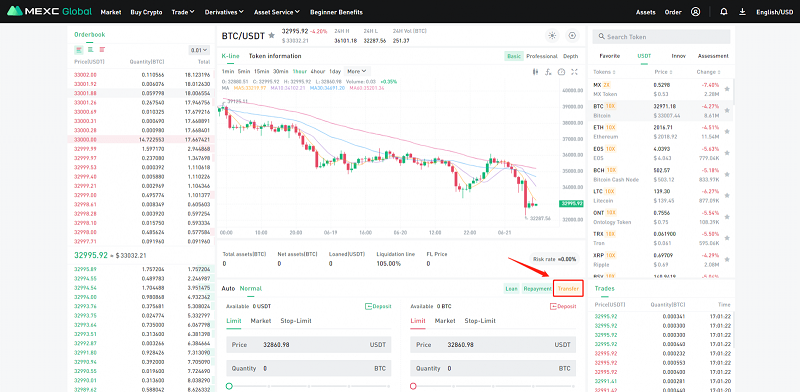

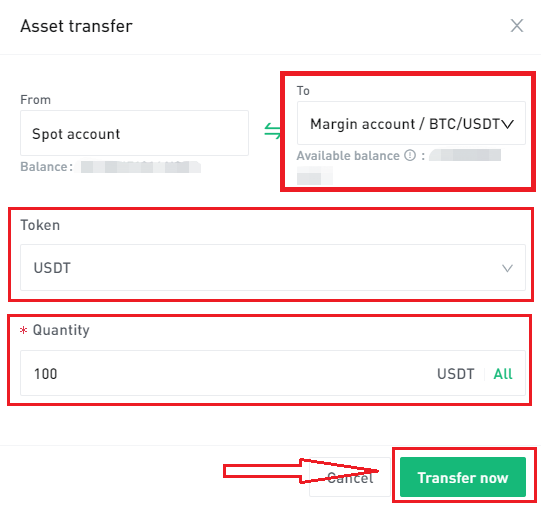

Step 2: Asset transfer

In this case, we will be using BTC/USDT margin trading pair as an example. The two tokens of the trading pair (BTC, USDT) can be transferred to the Margin Wallet as the collateral funds. Click [Transfer], choose the tokens and fill in the quantity you want to transfer to your Margin Wallet then click [Transfer now]. Your borrowing limit is based on the funds in your Margin wallet.

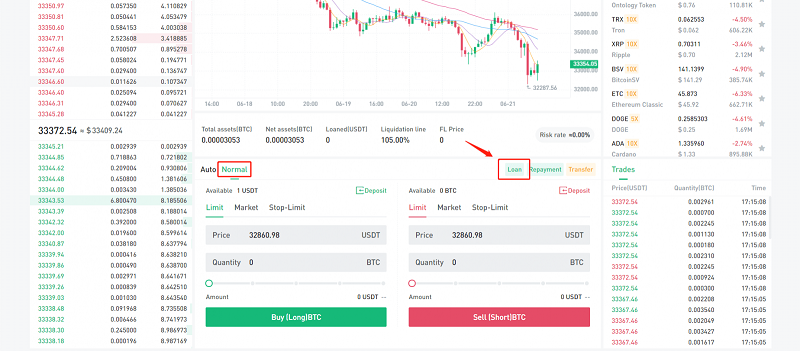

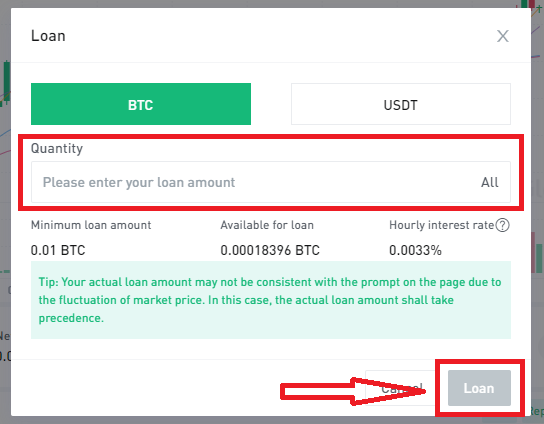

Step 3: Loan

After transferring the tokens to your Margin Wallet, you are now able to use the tokens as collateral to borrow funds.

Click [Loan] under the [Normal] mode. The system will display the amount available for borrow based on the collateral. Users can apply the loan amount according to their needs.

The minimum loan amount and hourly interest rate will also be shown in the system for easy reference. Fill in the quantity you want to loan and click "Loan".

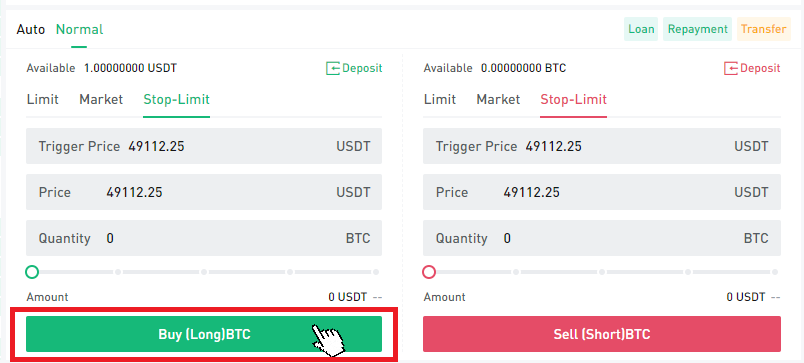

Step 4: Margin trading (Buy/Long or Sell Short)

Users can start Margin Trading once loan is successful. Heres what Buy/Long and Sell/Short means:

Buy/Long

Buying long on Margin Trading means expecting a bullish market in the near future to buy low and sell high whilst repaying the loan. If the price of BTC is expected to increase, you can choose to borrow USDT to buy BTC at a low price and sell it at a high price in the future.

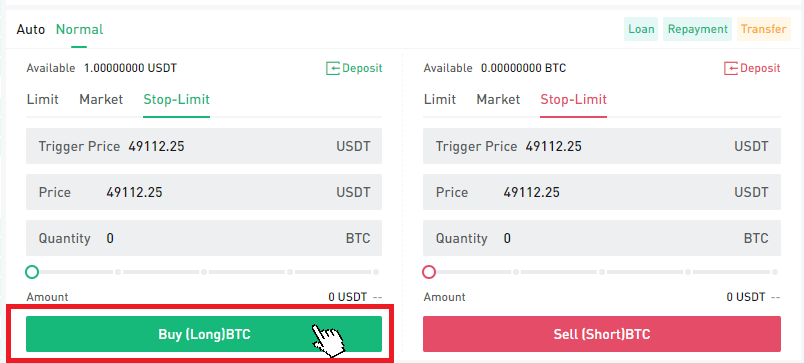

Users can choose between Limit, Market or Stop-Limit in [Normal] or [Auto] mode to buy/long BTC.

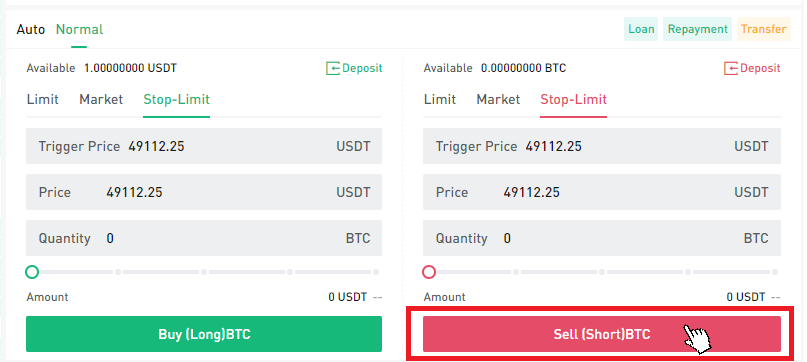

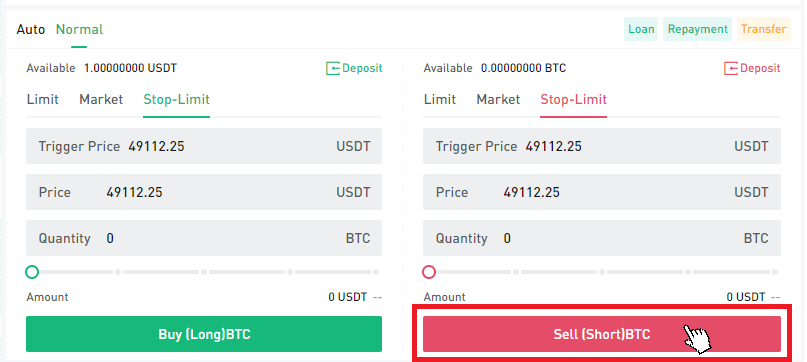

When the price of BTC goes up to the expected price, user can sell/short BTC by using Limit, Market or Stop-Limit.

Sell/Short

Selling short on Margin Trading means expecting a bearish market in the near future to sell high and buy low whilst repaying the loan. If the current BTC price is 40,000 USDT and it is expected to drop, you can choose to go short by borrowing BTC.

Users can choose between Limit, Market or Stop-Limit in [Normal] or [Auto] mode to sell/short BTC.

When the price of BTC goes down to the expected price, users can buy BTC with a lower price in Margin Trading to repay the loan and interest.

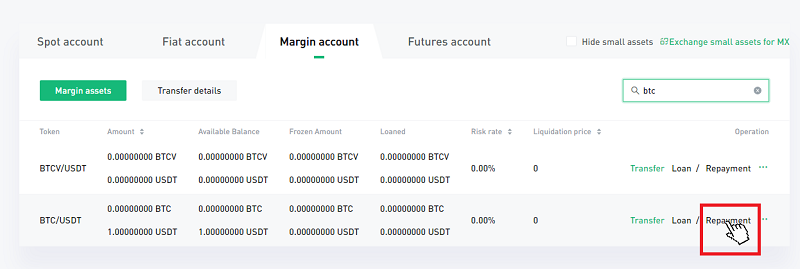

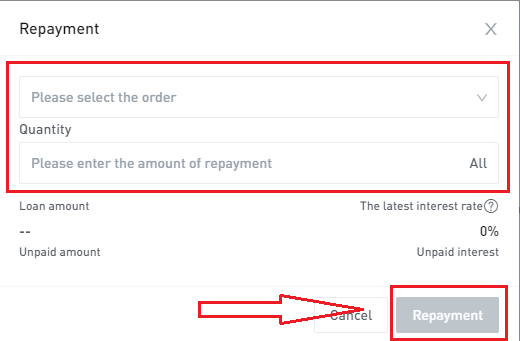

Step 5: Apply for repayment

Users can proceed with repayment by clicking [Assets - Account] - [Margin account]. Look for the tokens you have applied loan for (BTC, in this case), and click [Repayment]. Select the order that you would like to repay, key in the amount for repayment and click [Repayment] to proceed. If there is an insufficient amount for repayment, users have to transfer the required tokens into their Margin account to make the repayment in time.

Guide to Automatic Mode Feature in Margin Trading

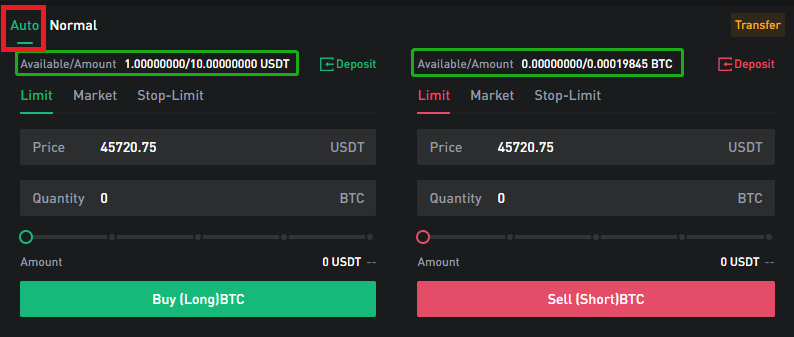

MEXC also provides Margin Trading in Auto mode to simplify trading processes and enhance users experience.

1. Loan and Repayment

By choosing Automatic mode in Margin Trading, users do not need to loan or repay manually. The system will judge whether the user needs a loan based on the available asset and order amount. If the order amount is greater than the users available asset, the system will perform a loan automatically, and the interest will be counted immediately. When the order is cancelled or partially filled, the system will repay the loan automatically to avoid the interest generated by the idle loan.

2. Available Amount/Quota

In Automatic mode, the system will display the available amount to users based on the leverage selected and the users asset in the Margin account (Available amount = Net asset + Maximum loan amount).

3. Unpaid Loan

If the user has an unpaid loan, the system will first repay the interest and then the loan amount when the user transfers the corresponding asset into margin account. Users will have to repay the outstanding loan to be able to switch trading modes.

Stop-Limit Order on Margin Trading

What is Stop-Limit order on Margin Trading?

Stop-Limit order allows traders to combine a limit order and a stop-loss order to mitigate risks by specifying the minimum amount of profit or the maximum loss they are willing to accept. Users can start by setting a stop price and a limit price. When the trigger price is reached, the system will automatically place the order even when you are logged out.

Parameters

Trigger price: When the token reaches the trigger price, the order will be placed automatically at the Limit price with the pre-set amount.

Price: The price for buy/sell

Quantity: The buy/sell amount in the order

Note: If theres a large market fluctuation when users are trading in Auto mode, the available loan will be changed. This may lead to the failure of the stop-limit order.

For example:

The market price of EOS is now higher than 2.5 USDT. User A believes that the 2.5 USDT price mark is an important support line. So User A thinks if the price of EOS falls below the price, he can apply for a loan to buy EOS. In this case, User A can leverage the stop-limit order and set the trigger prices and amount in advance. With this function, User A will have no need to actively monitor the market.

Note: If the token has experienced great volatility, the stop-limit order may fail to be executed.

How to place a Stop-Limit order?

1. Taking the above scenario as an example: On MEXCs website, find [Trade - Margin] on the menu bar - Click [Stop-Limit] in the preferred mode (Auto or Normal)

2. Set the Trigger Price at 2.7 USDT, Limit Price as 2.5 USDT and the buying amount of 35. Then, click "Buy". After placing the Stop-Limit order, the order status can be viewed under the [Stop-Limit order] interface below.

3. Upon the latest price reaching the stop price, the order can be viewed under the "Limit" menu.

Futures Trading on MEXC

Coin Margined Perpetual Contact Trading Tutorial【PC】

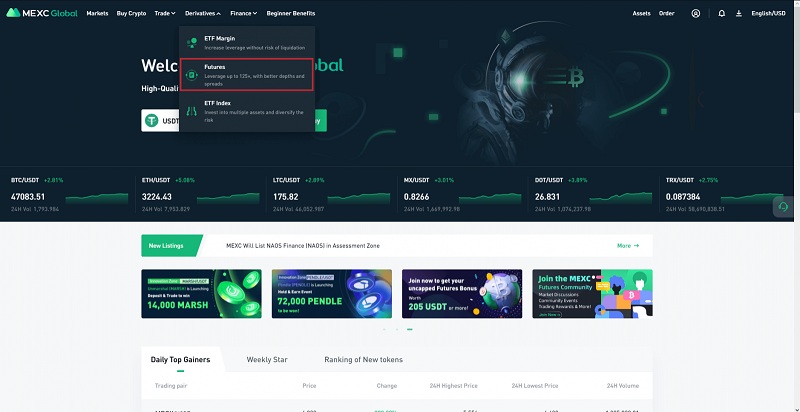

Step 1:

Login at https://www.mexc.io click "Derivatives" followed by "Futures" to enter the transaction page.

Step 2:

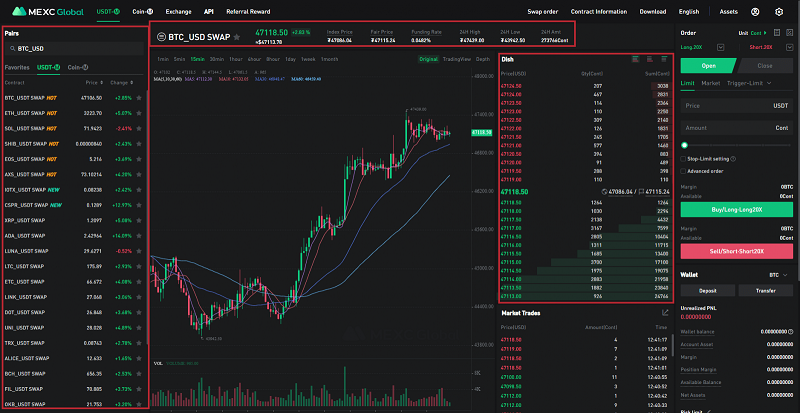

The futures page contains a wealth of data about the market. This is the price chart of your selected trading pair. You may toggle between the basic, pro and depth views by clicking the options in the top right of the screen.

Information about your positions and orders can be seen at the bottom of the screen.

The order book gives you insight into whether other brokerages are buying and selling while the market trades section gives you information about the recently completed trades.

Finally, you can place an order on the extreme right of the screen.

Step 3:

The coin-margined perpetual contract is a perpetual contract denominated in a certain kind of digital asset. MEXC currently offers BTC/USDT and ETH/USDT trading pairs. More will come in future. Here, we will purchase BTC/USDT in an example transaction.

Step 4:

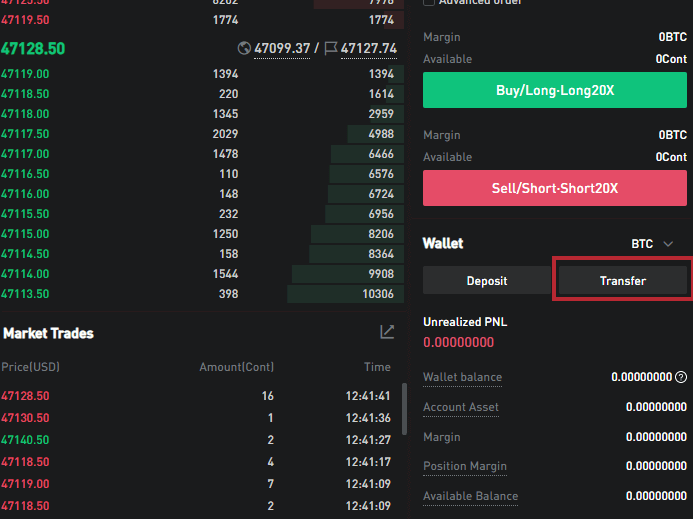

If you do not have sufficient funds, you may transfer your assets from your Spot account to your Contract account by clicking "Transfer" in the bottom right of the screen. If you do not have any funds in your Spot account, you may perform purchase tokens directly with fiat currency.

Step 5:

Once your contract account has the required funds, you may place your limit order by setting price and the number of contracts you would like to purchase. You may then click "Buy/Long" or "Sell/Short" to complete your order.

Step 6:

You may apply different amounts of leverage on different trading pairs. MEXC supports up to 125x leverage. Your maximum allowable leverage is dependent on the initial margin and maintenance margin, which determines the funds required to first open and then maintain a position.

You may change both your long and short position leverage in cross margin mode. Here's how you can do it.

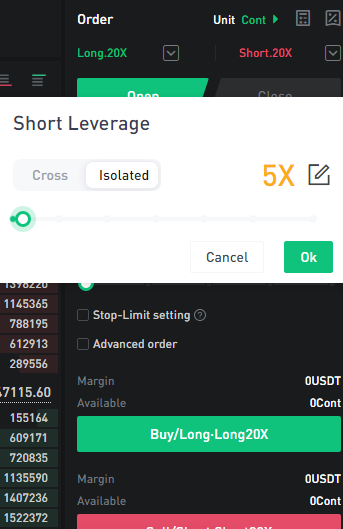

For instance the long position is 20x, and the short position is 100x. To decrease the risk of long and short hedging, the trader plans to adjust the leverage from 100x to 20x.

Please click "Short 100X" and adjust the leverage to the planned 20x, and then click "OK". Then the leverage of the position has now been reduced to 20x.

Step 7:

MEXC supports two different margin modes to accommodate differing trading strategies. They are Cross Margin mode and Isolated Margin mode.

Cross Margin Mode

In cross margin mode, margin is shared between open positions with the same settlement cryptocurrency. A position will draw more margin from the total account balance of the corresponding cryptocurrency to avoid liquidation. Any realised PnL can be used to increase the margin on a losing position within the same cryptocurrency type.

Isolated Margin

In isolated margin mode, margin assigned to a position is limited to the initial sum posted.

In the event of liquidation, the trader only loses margin for that specific position, leaving the balance of that specific cryptocurrency unaffected. Therefore, isolated margin mode allows traders to limit their losses to the initial margin and nothing more.

When in isolated margin mode, you can spontaneously optimise your leverage by means of the leverage slider.

By default, all traders start in isolated margin mode.

MEXC currently allows traders to change from isolated margin to cross margin mode in the middle of a trade, but in the opposite direction.

Step 8:

You may buy/go long on a position or sell/go short a position.

A trader goes long when they anticipate a price increase in a contract, purchasing at a lower price and selling it for a profit in the future.

A trader goes short when they anticipate a price decrease, selling at a higher price in the present and earning the difference when they re-purchase it in the future.

MEXC supports a variety of different order types to accommodate different trading strategies. We will next proceed to explain the different order types available.

Order Types

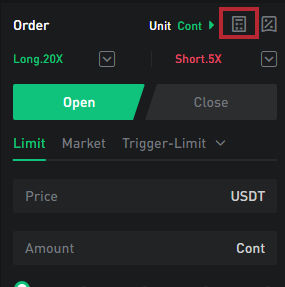

i) Limit order

Users can set a price that they are willing to buy or sell at, and that order is then filled at that price or better. Traders use this order type when price is prioritised over speed. If the trade order is matched immediately against an order already on the order book, it removes liquidity and the taker fee applies. If the trader's order is not matched immediately against an order already on the order book, it adds liquidity and the maker fee applies.

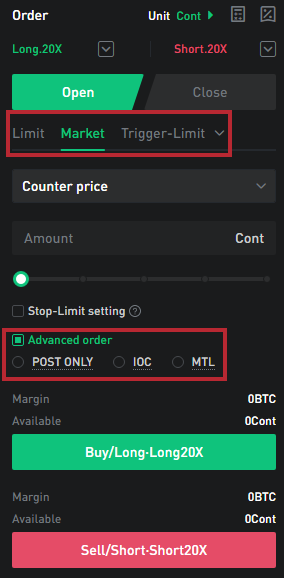

ii) Market order

A market order is an order to be executed immediately at current market prices. Traders use this order type when speed is prioritised over speed. The market order can guarantee the execution of orders but the execution price may fluctuate based on market conditions.

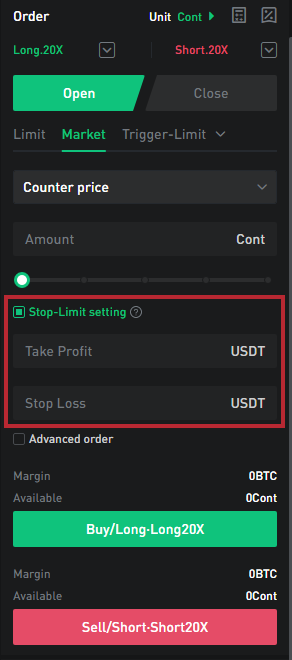

iii) Stop Limit Order

A Limit Order will be placed when the market reaches the Trigger Price. This can be used to stop loss or take profit.

iv) Immediate or Cancel Order (IOC)

If the order cannot be executed in full at the specified price, the remaining portion of the order will be cancelled.

v) Market to Limit Order (MTL)

A Market-to-Limit (MTL) order is submitted as a market order to execute at the best market price. If the order is only partially filled, the remainder of the order is canceled and re-submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed.

vi) Stop Loss/Take Profits

You may set your take-profits/stop-limit prices when opening a position.

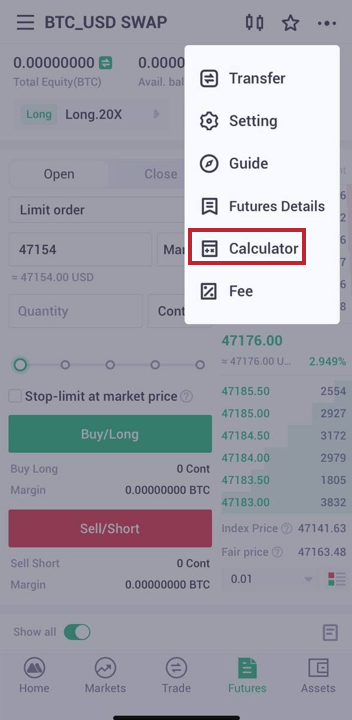

If you need to perform some basic arithmetic when trading, you may use the provided calculator function on the MEXC platform.

Coin Margined Perpetual Contract Trading Tutorial【APP】

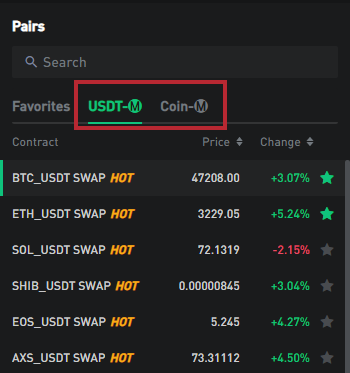

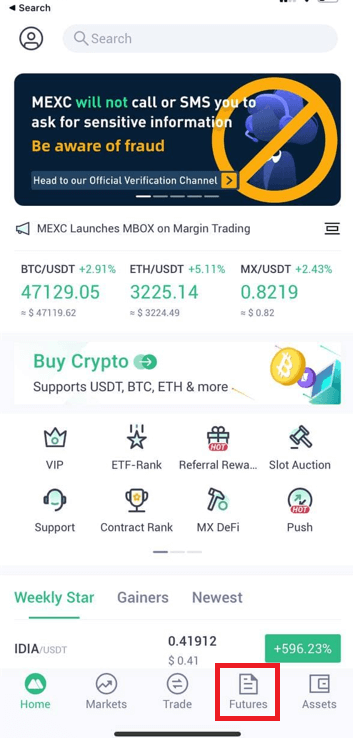

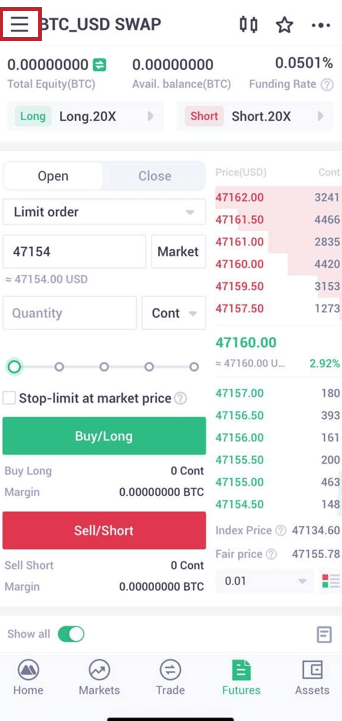

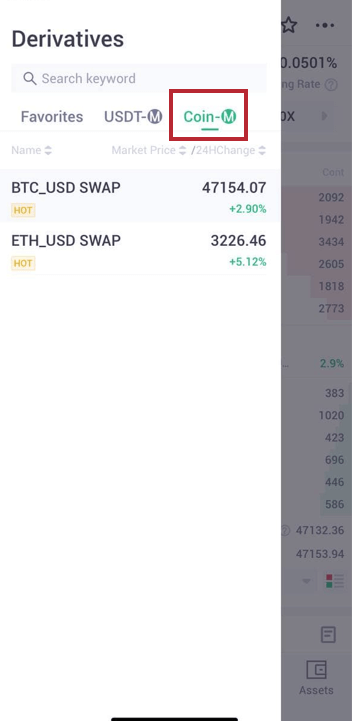

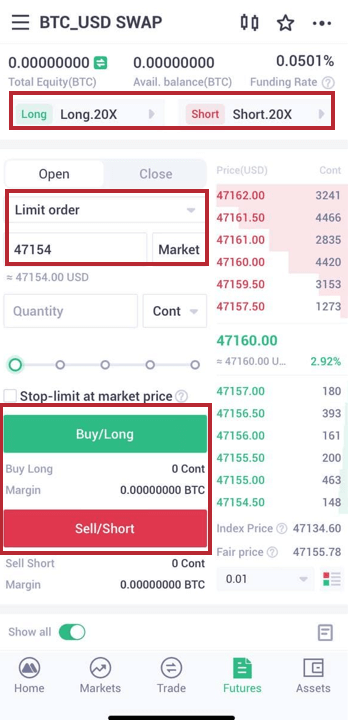

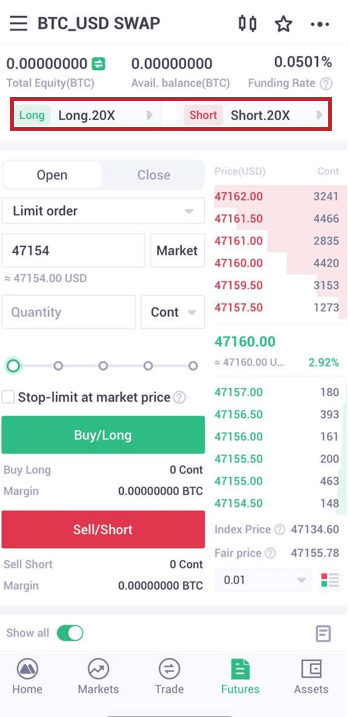

Step 1:Launch the MEXC app and tap "Futures" in the navigation bar at the bottom to access the contract trading interface. Next, tap the upper left corner to select your contract. Here, we will use the coin-margined BTC/USD as an example.

|

|

|

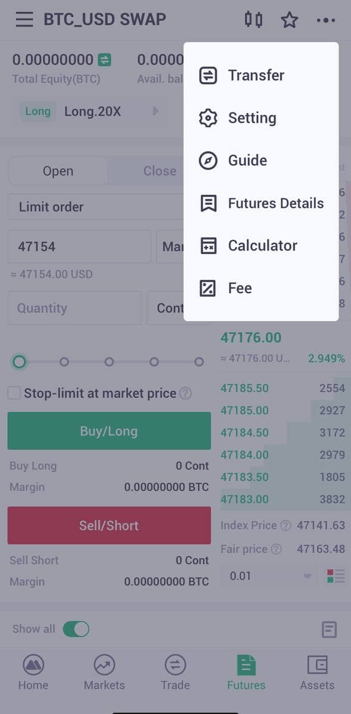

You may access the K-line diagram or your favourite items from the top right of the screen. You may also view the guide, and other miscellaneous settings from the ellipsis.

Step 3:

The coin-margined perpetual contract is a perpetual contract denominated in a certain kind of digital asset. MEXC currently offers BTC/USD and ETH/USDT trading pairs. More will come in future.

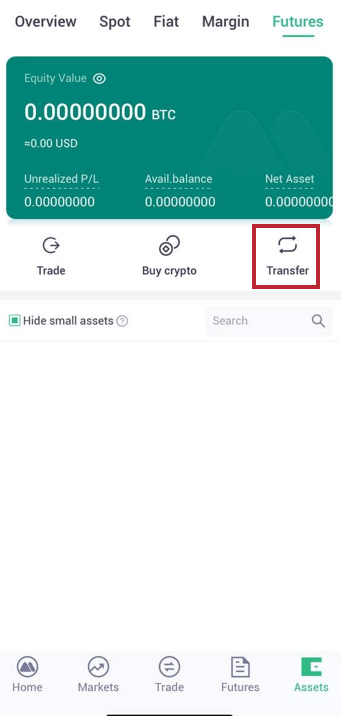

Step 4:

If you do not have sufficient funds, you may transfer your assets from your Spot account to your Contract account by clicking "Transfer" in the bottom right of the screen. If you do not have any funds in your Spot account, you may perform purchase tokens directly with fiat currency.

Step 5:

Once your contract account has the required funds, you may place your limit order by setting price and the number of contracts you would like to purchase. You may then click "Buy/Long" or "Sell/Short" to complete your order.

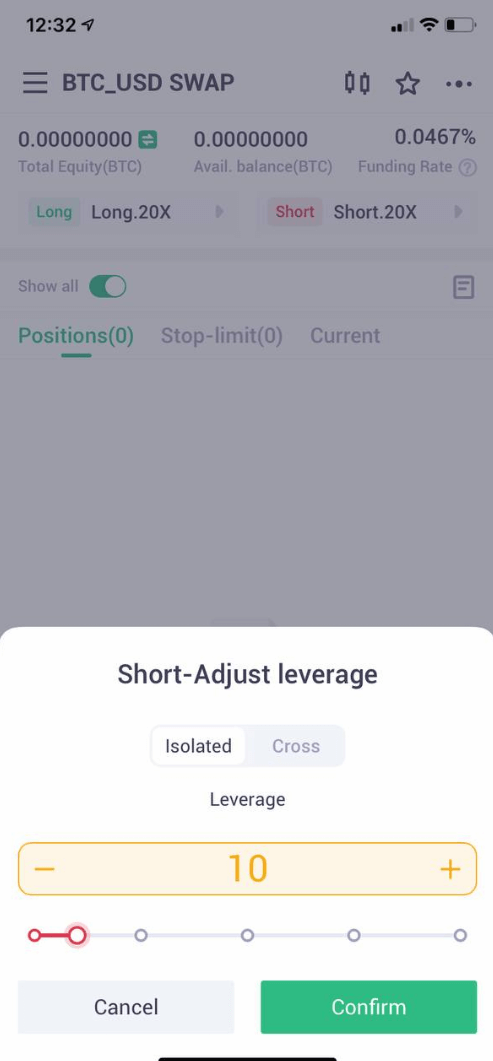

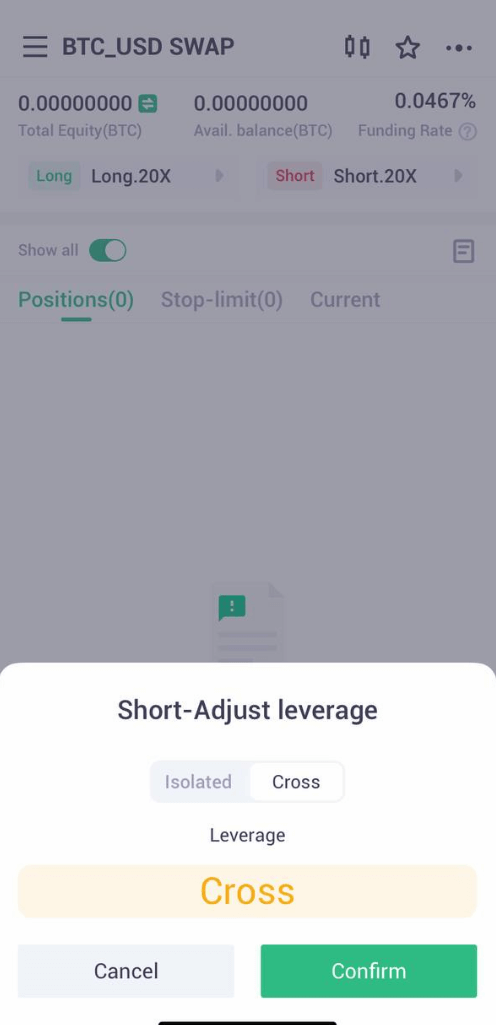

Step 6:

You may apply different amounts of leverage on different trading pairs. MEXC supports up to 125x leverage. Your maximum allowable leverage is dependent on the initial margin and maintenance margin, which determines the funds required to first open and then maintain a position.

You may change both your long and short position leverage in cross margin mode. For instance the long position is 20x, and the short position is 100x. To decrease the risk of long and short hedging, the trader plans to adjust the leverage from 100x to 20x.

Please click "Short 100X" and adjust the leverage to the planned 20x, and then click "OK". Then the leverage of the position has now been reduced to 20x.

Step 7:

MEXC supports two different margin modes to accommodate differing trading strategies. They are Cross Margin mode and Isolated Margin mode.

Cross Margin Mode

In cross margin mode, margin is shared between open positions with the same settlement cryptocurrency. A position will draw more margin from the total account balance of the corresponding cryptocurrency to avoid liquidation. Any realised PnL can be used to increase the margin on a losing position within the same cryptocurrency type.

Isolated Margin

In isolated margin mode, margin assigned to a position is limited to the initial sum posted.

In the event of liquidation, the trader only loses margin for that specific position, leaving the balance of that specific cryptocurrency unaffected. Therefore, isolated margin mode allows traders to limit their losses to the initial margin and nothing more. .

When in isolated margin mode, you can spontaneously optimise your leverage by means of the leverage slider.

By default, all traders start in isolated margin mode.

MEXC currently allows traders to change from isolated margin to cross margin mode in the middle of a trade, but in the opposite direction.

Step 8:

You may buy/go long on a position or sell/go short a position.

A trader goes long when they anticipate a price increase in a contract, purchasing at a lower price and selling it for a profit in the future.

A trader goes short when they anticipate a price decrease, selling at a higher price in the present and earning the difference when they re-purchase the contract in the future.

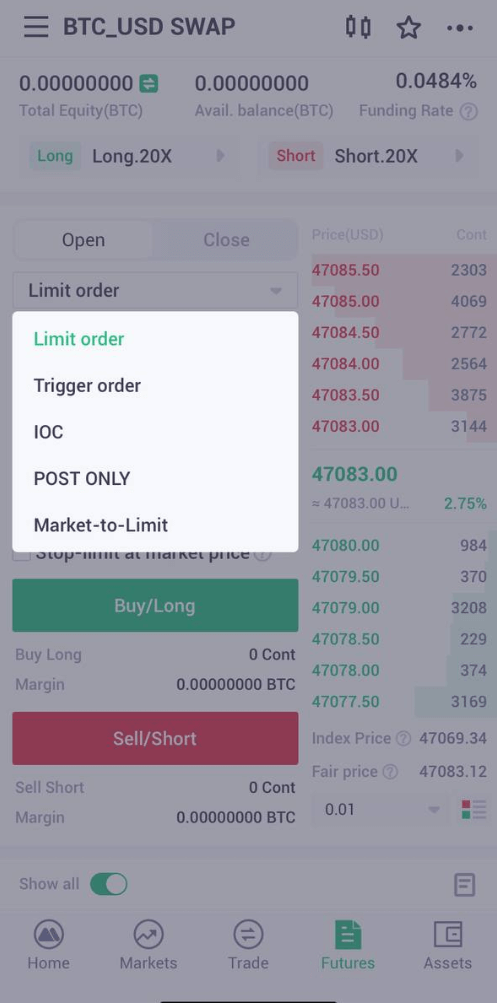

MEXC supports a variety of different order types to accommodate different trading strategies. We will next proceed to explain the different order types available.

Order

Limit order

Users can set a price that they are willing to buy or sell at, and that order is then filled at that price or better. Traders use this order type when price is prioritised over speed. If the trade order is matched immediately against an order already on the order book, it removes liquidity and the taker fee applies. If the trader's order is not matched immediately against an order already on the order book, it adds liquidity and the maker fee applies.

Market order

A market order is an order to be executed immediately at current market prices. Traders use this order type when speed is prioritised over speed. The market order can guarantee the execution of orders but the execution price may fluctuate based on market conditions.

Stop Limit Order

A Limit Order will be placed when the market reaches the Trigger Price. This can be used to stop loss or take profit.

Stop Market order

A stop market order is an order that can be used to take profits or stop losses. They become live when the market price of a product reaches a designated stop-order price and is then executed as a market order.

Order Fulfilment:

Orders are either fully filled at the order price (or better) or completely cancelled. Partial transactions are not allowed.

If you need to perform some basic arithmetic when trading, you may use the provided calculator function on the MEXC platform.

|

|